Abstract

This research explores the discrete and diversified characteristics of the cultural and creative industry (CCI) to identify and control their idiosyncratic risk in the open financial market. This article selects a panel data of cultural and creative companies listed in the Tianjin Cultural Art Exchange Market for the 2011 to 2017 period, to identify the influencing factors of their idiosyncratic risks through a multiple quality signal model. The results show that liquidity, market risk, and the characteristics of the cultural and creative industry have a significant impact on its idiosyncratic risk. It is worth noting that the impact of market risk on the idiosyncratic risk of publicly traded cultural and creative companies is limited within the industry, while trading of the external financial system has no significant impact on the idiosyncratic risk of the cultural and creative industry, therefore incurring no investment substitution effect. This paper concludes that the idiosyncratic risk of the CCI can be identified and controlled based on the liquidity, market risk and trading patterns of the cultural and creative companies listed in an open financial market. This helps creative industry entrepreneurs to assess the risk of their potential investments and policy makers to improve the surveillance mechanisms of the financial system.

Keywords: Financing cultural and creative industry, idiosyncratic risk, risk identification, multiple quality signals.

JEL: G14 Information and market efficiency, event studies, insider trading.

Resumen

Este trabajo explora las características discretas y diversificadas de la industria cultural y creativa (ICC) para identificar y controlar el riesgo idiosincrático de esta en el mercado abierto de capital financiero. Se selecciona y procesa un panel data de empresas de la industria cultural y creativa registrado en el Mercado Bursátil de Arte y Cultura de Tianjin, en el período 2011- 2017 para identificar los factores que influyen en el riesgo idiosincrático de la ICC a través de un modelo de señal múltiple de calidad. Los resultados muestran que la liquidez, el riesgo de mercado y las características particulares de la industria tienen un significativo impacto en el riesgo idiosincrático. Vale recalcar que el impacto del riesgo de mercado sobre el riesgo idiosincrático de la ICC se limita solo dentro de la industria, mientras que la compraventa en el sistema financiero externo no tiene impacto significativo en el riesgo idiosincrático de la ICC, por lo tanto, no se observa efecto de sustitución de inversión. La investigación concluye que el riesgo idiosincrático de la ICC puede ser identificado y controlado basado en la liquidez, el riesgo de mercado y el patrón de compraventa de las empresas en la ICC. Esto ayuda a los empresarios de esta industria a evaluar el riesgo financiero de potenciales inversiones y a los hacedores de la política pública a mejorar los mecanismos de vigilancia del sistema financiero.

Palabras clave: financiamiento de la industria cultural y creativa, riesgo idiosincrático, identificación de riesgo, señal múltiple de calidad

JEL: G14 Información y eficiencia del mercado, estudios de eventos, tráfico de información privilegiada.

Resumo

Este trabalho explora as características discretas e diversificadas da indústria cultural e criativa (ICC) para identificar e controlar o risco idiossincrático desta no mercado aberto de capital financeiro. Selecionaram-se e processaram-se dados em painel de empresas da indústria cultural e criativa registradas no Mercado de Ações de Arte e Cultura de Tianjin entre 2011 e 2017 para identificar os fatores que influenciam o risco idiossincrático da ICC por meio de um modelo de sinais múltiplos de qualidade. Os resultados mostram que a liquidez, o risco de mercado e as características particulares da indústria têm um significativo impacto sobre o risco idiossincrático. É válido ressaltar que o impacto do risco de mercado sobre o risco idiossincrático da ICC se limita à indústria, enquanto que a compra e venda no sistema financeiro externo não tem impacto significativo sobre o risco idiossincrático da ICC e, portanto, não se observa efeito de substituição de investimento. A pesquisa concluiu que o risco idiossincrático da ICC pode ser identificado e controlado com base na liquidez, no risco de mercado e no padrão de compra e venda das empresas da ICC. Isso ajuda os empresários de tal indústria a avaliar o risco financeiro de potenciais investimentos e os responsáveis pela política pública a melhorar os mecanismos de vigilância do sistema financeiro.

Palavras-chave: Financiamento da indústria cultural e criativa, risco idiossincrático, identificação de risco, sinais múltiplos de qualidade.

JEL: G14 Informação e eficiência de mercado, estudos de eventos, tráfego de informações internas.

Introduction

Cultural and creative industries are one of the fastest growing sectors in China; about two-thirds of them need financial resources, but currently there are few and scarce findings regarding their financial risk (Xu 2017). The output of the cultural production sector is more multifaceted than that of most industries in the economy, particularly because of its non-market attributes that create challenges to the decision-making of firms in the cultural and creative industries and to the formation of public policy application. One of these challenges is the identification and control of their financial risk, which often has non-standardized characteristics and is mostly idiosyncratic. Being able to identify these financial risks could lead to the strengthening of macro-prudential surveillance, which is conducive to improving the supervision of the entire financial system, while also preventing systemic risks from occurring in the financial market. At the same time, identifying and controlling these risks can ensure a healthy development of more inclusive financial schemes, as well as promoting innovation and the integration of the CCI in the financial system.

Financial support is essential for the development of the creative and cultural industry (McGrath et al. 2017). Financing and integrating more capital into the CCI with modern market mechanisms is one of the many optimal solutions (Wu 2014). Integrating CCIs into the financial industry has also given birth to a new market for the cultural and creative financial segment, which is key to make an assessment and securitization of cultural resources (Xi 2014). Depending on the source of capital and the type of financial merger, an array of financial models has been developed: endogenous cultural factors, financial models involving exogenous cultural factors, and models with mixed cultural factors (Liu 2014). Previous research also observes that the development of the cultural industry requires investment-driven financial capital. At the same time, the financing of the cultural and creative industries in the open market can also create systematic risk diversification. The development of cultural finance has a risk spillover effect that can accomplish a mutually beneficial situation between the cultural and creative industry and the financial industry (Zhang and Gu 2015).

The returns of commonly traded securities and CCI’s securities are usually similar; however, compared with financial indexes, the number of listed CCI companies are infrequent and their volatility is lower compared to commonly traded stocks. The volatility amplitude of CCI’s indexes is manifested through the uncertainty of new introduced technologies, the intrinsic cultural and use value that could be further divided into core or hidden values. Liang (2016) also pointed out that the heterogeneity of cultural assets lacks ruling standards, and the expected benefits generated by copyright, trademark rights, or strengthening cultural identity are difficult to evaluate. This leads to the implication that cultural and creative companies that are listed for public trading have non-standardized characteristics, and that their idiosyncratic trading risk is large.

In fact, idiosyncratic risks in financial markets have long been examined through various theories. One of the main staples of Portfolio Theory states that non-systemic or idiosyncratic risk can be reduced by increasing the number of securities in the portfolio (Wu 2009). Idiosyncratic risk refers to the individual risk of a financial institution that specifically targets its own assets (Li Kai and Shi Jinyan 2003; Zhao Guodong 2016). Standard asset pricing theory stipulates that idiosyncratic risks can be changed through diversified investment portfolios without the need for pricing. There is also research that suggests that idiosyncratic risks affect market returns and determine the predictability of the stock market (Goyal and Santa-Clara 2003). Considering liquidity, Vidal-Garcia et al. (2019) found that the importance of idiosyncratic risks can forecast fund returns. Additionally, idiosyncratic risks have a layered resonance, that is, when one industry suffers, the risks are extremely pervasive and contagious (Liu and Lu 2012). Investors not only require compensation for systemic changes in investment income, but also to avoid irreproducible idiosyncratic risks. These risks independently explain the 50-80 % risk premium of the Dow Jones Stocks. Finally, the variance of stock returns is mainly affected by its idiosyncratic component (Gourier 2016).

From the perspective of financial investment, the risk of investing in a new type of financial product is high, especially for experiential products related to art and culture, since the quality can only be revealed after consumption (Bharadwaj et al. 2017). Investors with high artistic literacy are also sensitive to the quality of the creative products and prefer high-quality financial products for the CCI, despite the costs of investment trading and risk-bearing capabilities. Furthermore, complex characteristics such as diverse business models, the discretionary management of projects, the difficulty to assess their s cultural value, and price uncertainty determines the inevitability and non-negligibility of idiosyncratic risk for CCI’s securities. Unlike traditional financial products, creative and cultural financial products have non-standardized features, few product types and investment channels, and their idiosyncratic risks have hidden characteristics. This makes these products harder to diversify by increasing the number of investment securities.

The existing literature also lacks quantitative research on the identification and hedging of financial risks for CCIs. This article, therefore selects a panel data of cultural and creative companies listed in the Tianjin Cultural Art Exchange Market for the 2011 to 2017 period in order to identify the idiosyncratic risks of a selected group of publicly registered cultural and creative companies using a multiple signal model. The article continues with a section that describes the theoretical and conceptual framework of this type of research. The third part explains the research design with a following section showing the results, and lastly a segment that concludes with implications of the findings.

Theoretical analysis and research assumptions

For cultural and creative financial companies listed for share trading, the estimation of idiosyncratic risk is most often an ex-post method, which is calculated based on the transaction price of the product after the transaction is completed. Measuring the size of idiosyncratic risks in creative and cultural securities not only helps the regulator to supervise the market, but also to predict risk and perform subsequent measures. Therefore, it is important to clarify the causes of idiosyncratic risk and analyze their influencing factors as well. Existing literature research shows that investors are often immersed in diversified market information, which can be used as a signal to analyze their investment choices (Bharadwaj et al. 2017). In other words, to avoid idiosyncratic risk of CCI’s securities, investors can capture relevant signals reflecting the fluctuation of product quality or value and make a sound investment. Multi-quality signal theory provides an entry point for idiosyncratic risk analysis of CCI financial products.

Signal theory was originally used to explain how the parties deal with uncertainty in the case of incomplete or asymmetric information (Spence 1973; 2002). Multi-quality signal theory aims to predict a new market by considering market choices and professional appraisals. The basic premise of this theory is that decision makers will use all available information to evaluate options, but they rarely have all the information available (Connelly et al. 2011). Signal theory is widely used in the film industry because its products are an experiential and quality information is distributed asymmetrically between producers and consumers (Basuroy et al. 2006; Akdeniz and Talay 2013; Bharadwaj et al. 2017). This is similar to CCI securities where the economic value of cultural and creative products is rooted in their inherent cultural value, which makes them have the characteristics of intangible experiential products. Their value can often be perceived only after consumption, increasing the uncertainty of investment.

According to signal theory, investors often face the stimulus of massive investment information, and this stimulus is like a signal, which has a great impact on investors’ understanding and feeling of product innovation, thus shaping the investment behavior of investors (Keller 1993; 2013). For experiential financial products such as CCI’s securities, it is difficult for investors to perceive product attributes or returns in advance, so they will look for signals to construct product quality information before investing (Calantone et al. 2010; Gemser et al. 2008). In other words, the theory of multiple quality signals places great emphasis on the application of unstructured data. Most recent research is limited to modeling the diversity of both structured and unstructured data to predict the success of innovation in data-rich environments (Bharadwaj and Noble 2015). For CCI’s securities, at least three quality clues are proposed: (1) relevant information of the product itself (unstructured data) before the CCI security is listed and traded; (2) the structure of the cultural and creative market after the listing and transaction data are revealed; (3) unstructured data from professional appraisals or market feedback after listing. Employing these three clues or signals can thus help identify and analyze the idiosyncratic risk of CCI’s securities.

Production and structural diversity are the basic characteristics of the cultural and creative industry, since their products range from museum visits, theater tickets, sales of audio recording, film distribution, or art auctions, and their organizational structure could also be private, public, mixed, freelance or part of a production chain. Accordingly, inherent risks are created due to the non-standardization of this industry’s production and structure. This non-standardization increases the risk of the capital market’s reaction to CCI’s securities, which not only increases investment costs, but also makes it difficult to predict the outcome of investment decisions. The complex layers of inherent capital market norms also hurdle the financial development of the CCI. As more complex and diverse cultural and creative products are created, this non-standardized production expands the uncertainty and causes more risk for the investment in CCI’s securities. Consequently, all these assumptions lead this study to propose the following hypotheses:

Hypothesis 1: Production and structural diversity in the CCI affects idiosyncratic risk for CCI’s securities. The greater the diversity, the greater the idiosyncratic risk of corresponding CCI securities.

From a macro-market perspective, the impact of non-standardization has both structural and environmental characteristics. The former includes, for example, firm size and type of product, while the latter includes micro-systems and macro-systems. The micro system refers to institutions and groups that have a direct impact on artists, such as art schools, galleries, and peer artists; the macro system describes the cultural context in which the artist lives, such as the national political environment, economic and social status, and level of technological progress.

Other recent studies have pointed out that there is a significant positive correlation between idiosyncratic risk and market risk (Gilchrist, Sim and Zakrajsek 2014; Bartram et al. 2017). Based on this, the following assumption is made:

Hypothesis 2: The overall financial industry risk of cultural and creative companies, that is, the uncertainty of market transactions of similar financial products will affect the idiosyncratic risks of CCI’s securities. The greater the financial risk of the CCI, the greater the idiosyncratic risk of its securities.

In addition, according to the arbitrage cost hypothesis, the more difficult the arbitrage is, i.e., the more the price deviates from the base value, the stronger the effect of idiosyncratic risk on market risk (Shleifer and Vishny 1997). CCI’s production is highly heterogeneous, with high investment thresholds and low transaction frequencies. Transaction costs such as appraisals, valuations, transportation, storage, and monetization are high, while liquidity is poor, and arbitrage becomes difficult to ascertain.

Regarding liquidity, the non-liquidity hypothesis holds that illiquid stock prices react slowly to changes in market information, and lagging market information also increases their idiosyncratic risk (Spiegel and Wang 2005). Bartram, Brown and Stulz (2017) believe that the lack of liquidity in stocks leads to a strong correlation between idiosyncratic risk and market risk, because market information is integrated faster in stocks with higher liquidity than stocks with less liquidity. Therefore, the poorer the liquidity of CCI’s securities, the greater the idiosyncratic risk. These assumptions lead to the following hypothesis:

Hypothesis 3: The liquidity of publicly listed culture and creative companies affects its idiosyncratic risk. The greater the illiquidity of these companies, the greater its idiosyncratic risk.

Research Design

Data source

The transaction data of Tianjin Cultural Art Exchange and Shanghai Stock Exchange from November 14, 2011 to December 31, 2017 were selected as research samples. The sample contains 19 different culture and creative companies (CCC) securities; some of these companies produce paints and sculptures, others are involved in the design of jewelry and jade artworks. The sample securities are listed and traded on the Tianjin Cultural Art Exchange using a share-based trading model. The transaction shares, listing time, and closing bids of each financial product are different, which makes the sample data set an unbalanced panel.

Variable settings

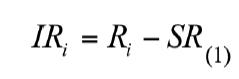

- The explanatory variable is idiosyncratic risk (IR). As an explanatory variable, the weekly idiosyncratic risk calculation formula for a single financial CCI security is as follows:

- The main explanatory variables are the structural diversity of cultural and creative companies, the risk of trading markets, and illiquidity. Among them, the diversity of CCI’s structure is measured by the product type dummy variable (k) and the size variable (size); the market risk for cultural and creative companies (SR) is measured by the fluctuation of the logarithmic rate of return of the composite index for cultural and creative securities. Yield fluctuations of the composite index measure the financial market risk of similar CCCs, which is the main factor affecting the idiosyncratic risk of a single CCC’s securities; liquidity is measured by the average weekly trade volume of each CCC. The lesser the average weekly trading volume, the stronger the illiquidity.

- Market risk (MR) is measured by the fluctuation of the weekly market return (standard deviation and variance) of the Shanghai Stock Exchange A-share market considering cash dividend reinvestment, as a substitute variable and a control variable for macro policy changes. Shanghai Stock Exchange index is chosen as the standard reference for rate of return, which helps ascertain investment substitution effect.

Where R represents theº total risk faced by a single cultural and creative company’s security traded weekly, and SR (Systemic Risk) represents the fluctuation of the weekly composite index published by the Tianjin Culture and Art Exchange, also known as the systematic risk of this exchange market. Each index risk is calculated by using the variance of its logarithmic rate of return:

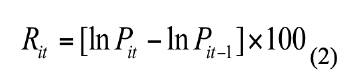

Where Pit represents the closing price of product i in period t.

The descriptive statistics of each variable are shown in Table 1. Among them, the dummy variable k1 = 1 indicates the painting and sculpture stock type and k2 = 1 indicates the jewelry and jade stock type. According to the analysis above, the explanatory variables mainly include ex-ante signals that reflect individual characteristics of the CCC and historical information of the Shanghai Stock Exchange A-share market, as well as ex-post signals of the cultural and creative market risk, CCC liquidity and A-share market risk. Descriptive statistics show that the study sample is an unbalanced panel.

Table 1

Descriptive Statistics and Variables

| Variable | Group | Mean | Coefficient | Observations | Attribute |

|---|---|---|---|---|---|

| IR | All | 4.186 | 24.499 | N = 5715 | Explanatory Variable |

| Intergroup | 2.607 | n = 19 | |||

| Intragroup | 24.366 | T-bar = 300.789 | |||

| SR | All | 1.37 | 7.603 | N = 5601 | Ex-Post Signal |

| Intergroup | 0.076 | n = 19 | |||

| Intragroup | 7.603 | T-bar = 294.789 | |||

| MR | All | 0.023 | 0.016 | N = 5696 | Ex-Ante/Ex-Post Signal |

| Intergroup | 0.00009 | n = 19 | |||

| Intergroup | 0.016 | T-bar = 299.789 | |||

| Liquidity | All | 298.024 | 2815.222 | N = 5648 | Ex-Post Signal |

| Intergroup | 249.808 | n = 19 | |||

| Intergroup | 2804.635 | T-bar = 297.263 | |||

| Variable | Group | Mean | Coefficient | Observations | Attribute |

| k1 | All | 0.628 | 0.483 | N = 5715 | Ex-Post Signal |

| Intergroup | 0.496 | n = 19 | |||

| Intergroup | 0 | T-bar = 300.789 | |||

| k2 | All | 0.106 | 0.3083589 | N = 5715 | Ex-Ante Signal |

| Intergroup | 0.3153018 | n = 19 | |||

| Intergroup | 0 | T-bar = 300.789 | |||

| Size | All | 74.557.34 | 110.030.7 | N = 5715 | Ex-Ante |

| Intergroup | 113.421.5 | n = 19 | |||

| Intergroup | 2.16 | T-bar = 300.789 |

Source: The author.

Selection of empirical models

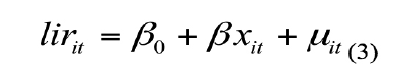

In order to facilitate the analysis, logarithmic de-dimension processing is performed for each variable, and a panel regression model is used, as follows:

In the formula, xit represents the explanatory variable, i.e., the pre- and post-signal variables mentioned above, and mit represents the error term, including factors that may be omitted which have an influence on the explained variable. The subscripts i and t represent individuals and time, respectively.

Analysis of Empirical Test Results

Regression of panel data of overall effect

The panel regression results of the overall effect are shown in Table 2. Models (1) and (2) are mixed regressions, and (3) and (4) are fixed-effect regressions that consider individual effects. The regression results of the mixed model (1) show that the systemic risk, illiquidity, and type of artworks in the financial market of CCCs have a significant positive impact on their idiosyncratic risks. Assumptions 1, 2, and 3 are true. Among the overall effects reflected by the regression results of the mixed model, the regression coefficient of the artwork type variable is significant, which means that individual characteristics have a significant impact on the explanatory variables, which is consistent with the regression results of the fixed effect model that controls the individual effects. The type and size of artworks that are listed and traded on the market will affect their idiosyncratic risks and are a determinant of the fluctuations in the returns of their financial products. From regression results, the regression coefficients of the k1 and size variables are significant, which means that the idiosyncratic risk of paintings and sculptures is significantly higher than that of jewelry and jade. The larger the size of the CCCs, the greater the idiosyncratic risk. This is the same for paintings and sculptures. The fact that the value retention is less for paintings and sculptures than that of jewelry and jade is because the larger size makes them difficult assets to retain or trade.

In addition, the price of CCC’s securities has an anchoring effect. Buyers’anchoring depends either on the previous sale price or pre-sale valuation. Past prices also affect sellers’ views on their true value (Beggs and Graddy 2009; Huang and Tang 2014). For investors, the value of the explanatory variable in the past period is also a valuable ex-ante signal. Therefore, the first-order lag terms of the explanatory variables are added to the models (2) and (4). The regression results show that the systemic risk in the cultural and creative financial market has a significant impact on the idiosyncratic risk of a CCC security

The regression coefficients of the control variables are not significant, which means that the Shanghai A-share market risk has no significant impact on the idiosyncratic risk of the selected CCC’s securities. This shows precisely that the investment in cultural and creative securities is relatively independent of the A-share market for the sample selection period, and that the substitution effect of investment is not noticeable. This may be due to the late development of the creative and cultural financial market since the coverage of these types of stocks is small, or perhaps the investment mass is more concentrated; or it may be because cultural and creative financial products rely on the perception of the market and the perdurable value of the artwork itself. Whatever the reason, the regression results can at least provide an alternative for investors to diversify their investment risks.

Table 2

Regression results and overall effects

| Variable | Mixed model | Fixed effect models | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| ISR | 0.070*** | 0.087*** | 0.066** | 0.082*** |

| (-0.024) | (-0.022) | (-0.025) | (-0.023) | |

| IMR | 0.017 | 0.04 | 0.022 | 0.048 |

| (-0.047) | (-0.052) | (-0.048) | (-0.052) | |

| lliquidity | 0.023** | 0.026** | 0.022* | 0.027** |

| (-0.01) | (-0.01) | (-0.011) | (-0.011) | |

| k1 | 0.168** | 0.141* | ||

| (-0.08) | (-0.074) | |||

| k2 | -0.015 | -0.03 | ||

| (-0.053) | (-0.061) | |||

| Size | -0.000*** | -0.000*** | ||

| (0) | (0) | |||

| L.lIR | 0.163*** | 0.155*** | ||

| (-0.025) | (-0.026) | |||

| Constant | 1.618*** | 1.522*** | 1.658*** | 1.567*** |

| (-0.194) | (-0.216) | (-0.195) | (-0.219) | |

| Country FE | YES | YES | ||

| Observations | 2,510 | 1,992 | 2,510 | 1.992 |

| R-squared | 0.012 | 0.045 | 0.007 | 0.035 |

Note: *, **, and *** indicate significance level of 10, 5, and 1 %,

respectively. Parentheses shows the robust standard

errors with individual clustering variables.

Source: The author.

Robustness test: instrumental variable method

The explanatory variables of the above regression model include the systemic risk (SR) of the creative and cultural financial trading market. Since endogenous problems may arise, the model needs to be re-tested for robustness. This study uses the panel tool variable method to solve the problem of possible endogenous variables. Specifically, the lag term of the explained variable is used as the tool variable instead of the endogenous variable SR. Then two-stage least square estimation and generalized method of moments (GMM) are performed and compared with each other.

Model results (5) and (7) are inter-group estimates that control individual effects, and are instrumental variable methods based on fixed-effect models of dispersion and transformation; (6) and (8) are based on first-order differential for fixed-effect models, which come from the instrumental variable method. Regardless of the method, the results of the robust estimation using the lag of the explanatory variable to replace the possible endogenous variable SR, the systemic risk of the financial market still has a significant impact on the idiosyncratic risk of selected CCC’s securities. However, under the effect of instrumental variables, the regression coefficient becomes negative, and other explanatory variables become insignificant. This may be because the lag term of the explanatory variable itself is also a prior signal that affects its value. Therefore, the regression results of the instrumental variables with different processing are still consistent with the fixed effect model.

Table 3

Robustness estimates

| 2SLS | GMM | |||

|---|---|---|---|---|

| Variable | (5) | (6) | (7) | (8) |

| lir | D. lir | lir | D. lir | |

| ISR | -2.084* | -2.084* | ||

| (-1.107) | (-1.106) | |||

| IMR | -0.08 | -0.08 | ||

| (-0.12) | (-0.12) | |||

| lliquidity | -0.116 | -0.116 | ||

| (-0.076) | (-0.076) | |||

| D. lSR | 2.747*** | 2.747*** | ||

| (-0.537) | (-0.537) | |||

| D. lMR | -0.121 | -0.121 | ||

| (-0.153) | (-0.152) | |||

| 2SLS | GMM | |||

| Variable | (5) | (6) | (7) | (8) |

| lir | D. lir | lir | D. lir | |

| D. lliquidity | 0.064 | 0.064 | ||

| (-0.065) | (-0.065) | |||

| Constant | -0.324 | -0.005 | -0.005 | |

| (-1.122) | (-1.121) | (-1.121) | ||

| Country FE | YES | YES | YES | YES |

| Observations | 1,614 | 1,168 | 1,614 | 1,168 |

| chi2 | 516.1 | 26.21 | ||

| Sargan | 1.191 | 16.24 | ||

Note: *, **, and *** indicate significance level of 10, 5, and 1 %,

respectively. Parentheses shows the robust standard

errors with individual clustering variables.

Source: The author.

Conclusion

The research in this article reveals the non-dispersion of idiosyncratic risks for financial products of the CCI. Through regression analysis, it was possible to decipher some possible influencing factors in understanding how risk is related to the securities of the creative and cultural industry. The empirical test results show that the overall financial risk in the cultural and creative industry, its liquidity, its own diversity and structure, and its trading patterns, can significantly impact its idiosyncratic risk. It is worth pointing out that, unlike previous studies, the impact of external financial markets on the idiosyncratic risk of CCC’s financial products is not significant. The results for potential investors in financial products of the CCI implies that certain risks can be identified and controlled. Idiosyncratic risk for financial products of the CCI is related to the pricing of their production, type of production, liquidity of the listed CCC, and the market risk of the CCI based on trading volume.

Additionally, the research in this article has the following implications: (1) cultural and creative products are emotional assets. For those who value the emotional value of owning a financial product created by the CCI, risk can be reduced by diversifying the portfolio. However, this approach does not make up for the loss of emotional value suffered by giving up the related asset. (2) The multiple and discrete characteristics of artistic creations (e.g. masterpiece effects, secondary effect post consumption) associated with idiosyncratic risks leads to a portfolio with limited listings and reduced number of trading securities for creative and cultural companies, which also leads to a relatively small number of investors. This is turn reduces the degree of diversification needed to disperse the idiosyncratic risk in the investment of financial products in the CCI. (3) Multi-quality signal theory can help identify idiosyncratic risks of financial products of the CCI. Specifically, it can engage in pre-signal and post-signal processing to comprehensively examine market risk and other individual characteristics. In the era of big data, media evaluation and investor reputation can be fully mined as a supplement to quality signals.

The original intention of studying the idiosyncratic risks of CCI’s financial product not only provides a guide for the cultural and creative industry to expand financing channels, but also provides notions for the development of a more inclusive financial market. Based on the analysis of many factors that affect the idiosyncratic risks of CCI securities, several suggestions can be made to achieve risk aversion and control: (1) the establishment of a “boutique fund” dedicated to investment in CCI’s securities (Pownall 2013). Boutique funds can reduce the idiosyncratic risk of financial investment in CCI’s securities, because many syndicate-owned boutique funds have both a large share of CCI’s securities, which allows them to appreciate and hedge risks by diversifying the overall portfolio. (2) Redefining the valuation of investment products. Financial investment in the cultural and creative industry must consider both financial returns and aesthetic returns and recalibrate the value of its artworks and the risk assessment before investors enter the market. (3) Clarifying the difference between collection and investment, in order to avoid blind investment. Learning to adapt to the ever-changing macro environment and being able to read multiple quality signals can avoid losses due to the herd effect of the investment market. For example, when the cultural and creative market is booming and artwork prices are rising and increasing in value, investment in financial products of this industry also increases. Conversely, when low liquidity and low trading volume in the financial market of the CCI is observed, investment in CCI’s securities should be reduced.

References

Akdeniz, Brillur M., and Mehmet Berk Talay. 2013. “Cultural Variations in the Use of Market Signals: A Multilevel Analysis of the Motion Picture Industry”. Journal of the Academy of Marketing Science 41 (5): 601-624.

Bartram, Söhnke M., Gregory Brown and René Stulz. 2017. “Why Does Idiosyncratic Risk Increase with Market Risk?” CESifo Working Paper, No. 6560, 19 March. https://papers. ssrn.com/sol3/papers.cfm?abstract_id=3014723.

Bharadwaj, Neeraj, Charles H. Noble and Anette Tower. 2017. “Predicting Innovation Success in the Motion Picture Industry: The Influence of Multiple Quality ASignals”. Journal of Product Innovation Management 34 (5): 659-680. https://doi.org/10.1111/jpim.12404.

Bharadwaj, Neeraj, and Charles H. Noble. 2015. “Innovation in Data-rich Environments”. Journal of Product Innovation Management 32 (3): 476-478. https://doi.org/10.1111/jpim.12266.

Basuroy, Suman, Kalpesh Kaushik Desai and Debabrata Talukdar. 2006. “An empirical investigation of signaling in the motion picture industry”. Journal of Marketing Research 43 (2): 287-295.

Beggs, Alan, and Kathryn Graddy. 2009. “Anchoring Effects: Evidence from Art Auctions”. The American Economic Review 99 (3): 1027-1039.

Calantone, Roger, Sengun Yeniyurt, Janell D. Townsend and Jeffrey B. Schmidt. 2010. “The Effects of Competition in Short Product Life-cycle Markets: The Case of Motion Pictures”. Journal of Product Innovation Management 27 (3): 349-61. https://doi. org/10.1111/j.1540-5885.2010.00721.x.

Connelly, Brian, Trevis Certo, Duane Ireland and Christopher Reutzel. 2011. “Signaling Theory: A Review and Assessment”. Journal of Management 37 (1): 39-67. https://doi. org/10.1177/0149206310388419.

Gilchrist, Simon, Jae Sim and Egon Zakrajsek. 2014. “Uncertainty, Financial Frictions, and Investment Dynamics”. Working paper, 19 March. https://bit.ly/2CUmdNq. www.nber. org/papers/w20038.

Goyal Amit, and Pedro Santa-Clara. 2003. “Idiosyncratic risk matters!”. The Journal of Finance 58 (3): 975-1007. https://doi.org/10.1111/1540-6261.00555.

Gourier, Elise. 2016. “Pricing of Idiosyncratic Equity and Variance Risks”. Working Papers 781, 10 January. www.elisegourier.com/uploads/3/7/9/6/37964671/singleauthorpaper.pdf.

Huang Juan, Tang Shancai. 2014. “Art Financial Markets: A Documentary Review, Studies of International Finance”. Journal of Economic Perspectives 21 (2): 79-88. https://kns.cnki.net/ kcms/detail/detail.aspx?dbcode=CJFD&filename=GJJR201402009&dbname=CJFD2014.

Keller, Kevin Lane. 1993. “Conceptualizing, Measuring, and Managing Customer-based Brand Equity”. Journal of Marketing 57 (1): 1-22.

Keller, Kevin Lane. 2013. Strategic Brand Management: Building, Measuring, and Managing Brand Equity. Boston: Pearson.

Li Kai, Shi Jinyan. 2003. “Analysis of Chinese Security Fund Nonsystematic Risk”. Social Science 5 (3): 172-174.

Liu Ye, and Lu Yajuan. 2012. “Research on Integrating Evaluation and Surveillance for Non-system Risk in Financial Institutions: New Thinking in Post-crisis Era”. Finance & Trade Economics 2: 66-72.

McGrath, Tara, Renaud Legoux and Sylvain Sénécal. 2017. “Balancing the Score: The financial Impact of Resource Dependence On Symphony Orchestras”. Journal of Cultural Economics 41 (4): 421-439. 10.1007/s10824-016-9271-z.

Pownall, Rachel A.J. 2013. “Valuing the Non-pecuniary Benefits of Assets Using Probability Weighting Functions”. Working paper. Maastricht University. Accessed 04.04. https://bit. ly/31m68t2.

Shleifer, Andrei, and Robert Vishny. 1997. “The Limits of Arbitrage”. Journal of Finance 52: 35-55. https://doi.org/10.1111/j.1540-6261.1997.tb03807.x.

Stein, John P. 1977. “The Monetary Appreciation of Painting”. Journal of Political Economy 85: 1021-1035.

Spence, Michael. 1973. “Job Market Signaling”. The Quarterly Journal of Economics 87 (3): 355-74. https://bit.ly/3aQrrGE.

---. 2002. “Signaling in Retrospect and the Informational Structure of Markets”. The American Economic Review 92 (3): 434-59.

Spiegel, Matthew, and Xiaotong Wang. 2005. “Cross-sectional Variation in Stock Returns: Liquidity and Idiosyncratic Risk”. Working paper. Accessed April 2005. 23.04. https:// papers.ssrn.com/sol3/papers.cfm?abstract_id=709781.

Vidal-García Javier, Marta Vidal and Duc Khuong Nguyen. 2016. “Do Liquidity and Idiosyncratic Risk Matter? Evidence from The European Mutual Fund Market”. Review of Quantitative Finance and Accounting 47 (2): 213-247. Midwest Finance Association 2013 Annual Meeting Paper. Available at SSRN: https://bit.ly/38hazJP.

Vidal-García, Javier, Marta Vidal, Sabri Boubaker and Riadh Manita. 2019. “Idiosyncratic Risk and Mutual Fund Performance”. Annals of Operations Research 281 (1-2): 349-372. https://doi.org/10.1007/s10479-018-2794-2.

Wu Xiaoqiu. 2009. Portfolio Investment. Beijing: China Renmin University Press.

Xi, Mu. 2014. “Cultural Financial New Development Framework and Vision of Cultural Industries”. Humanities and Social Sciences 12 (1): 50-57.

Xiao-Peng, Hu. 2006. “Research on the Cultural Creative Industry Based on Capital Property”. China Industrial Economy 12: 5-12. https://bit.ly/3hssxL4.

Xu, Weishuang. 2017. “Research on the Causes and Coping Strategies of Financing Constraints of Small and Medium-Sized Cultural Enterprises”. In 7th International Conference on Management, Education, Information and Control (MEICI 2017). Atlanta, 19 November. https://bit.ly/3ez9I8u.

Zhao Guodong, Chen Xiao and Lu Haoru. 2016. “An Empirical Study on the Factors of Non-systemic Risk Influence of Listed Companies in Chinese Financial Industry”. Contemporary Finance 4: 30-33. https://bit.ly/2TXKAP5.

Zhang Suqiu, Gujiang. 2015. “Cultural Financial Risk Spillover Effects on Their Integrational Development”. Statistics & Information Forum 20 (6): 53-58. https://bit.ly/368BV21.